Aug. 1, 2018 | InBrief

Do you measure up in the subscription world?

Post-sale functions now have a broader mission to drive customer adoption, retention, and expansion

Do you measure up in the subscription world?

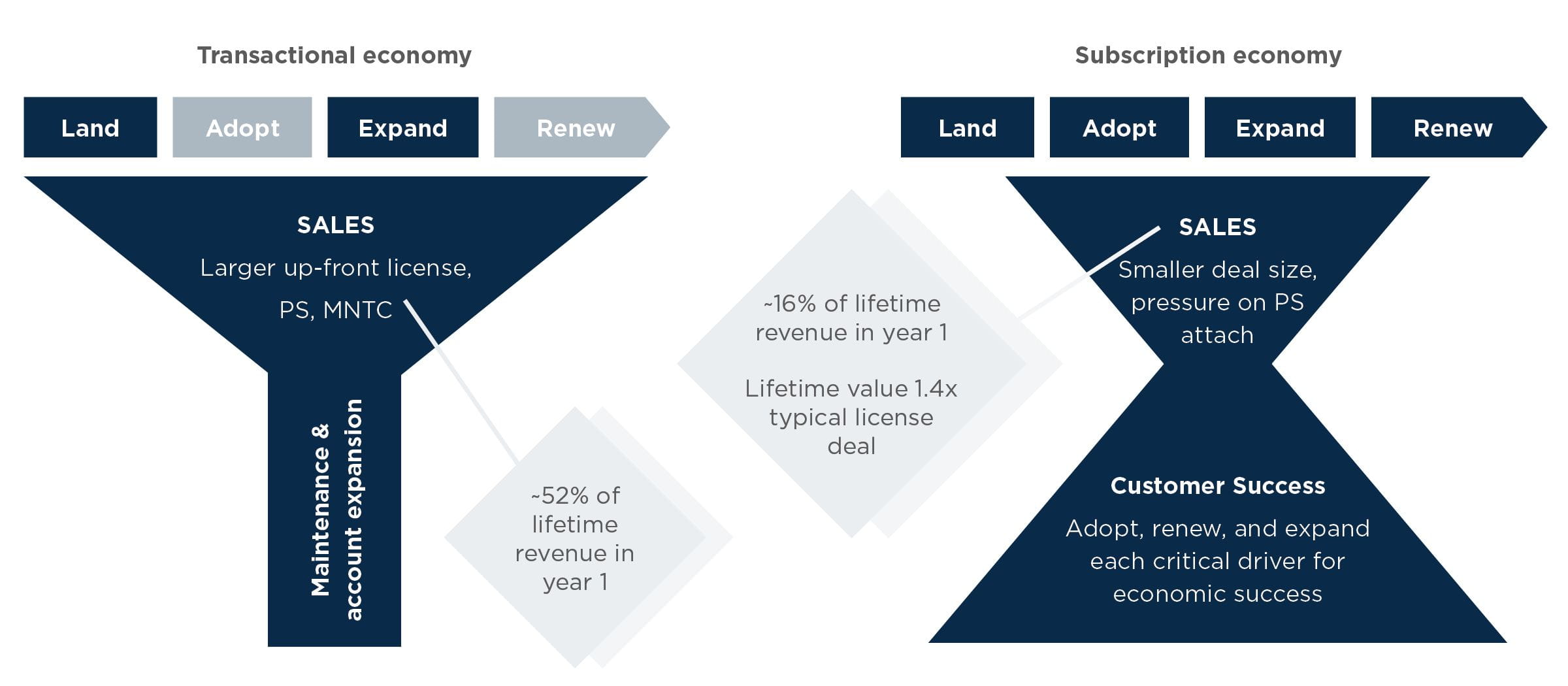

The focus on post-sale operations has grown with the shift to subscription and cloud. Whether you’re pure-play SaaS or legacy on-premise software provider transitioning to SaaS, executing on a post-sales engagement model is critical for sustainable growth.

As the graphic above illustrates, the growth of subscription businesses is largely determined after the initial sale through customer retention and expansion efforts.

And who drives these efforts? Customer Success and Services.

These functions play a lead role in retention and serve an increasingly important role in expansion efforts. We’re also beginning to see these functions support acquisition efforts.

Post-Sale Operating Models Are Rapidly Transforming to Support the Subscription Mandate

Post-sale functions now have a broader mission to drive customer adoption, retention and expansion:

- Customer Success: CS organizations continue to focus on driving gross and net retention rates, but with an increased emphasis on delivery efficiency (i.e., segmented coverage models).

- Cloud Services: Companies are seeking increased rigor around measuring performance and understanding the efficiency of cloud service delivery across the customer lifecycle (acquisition, retention, expansion).

- Customer Support: Support organizations are increasingly leveraging low-cost delivery channels (i.e., self-service) and monetizing premium support/success tiers.

- Professional Services: PS organizations are shifting strategic priorities to accelerate customer time to value and optimize customer usage and adoption.

- Managed Services: Software companies are increasingly developing Managed Service offerings to drive new, recurring revenue streams.

Metrics and Benchmarks Must Evolve Too

While traditional operating metrics (margins, attach rates, utilization, etc.) continue to be useful, they don’t reflect the full value (and cost) represented by the Services portfolio. New benchmarks and metrics are required to better measure the progress, efficiency and value of post-sale functions.

Here are three key metric categories that should be on every executive dashboard today:

1. Revenue Retention Rate (Net and Gross)

Revenue retention rate measures the amount of recurring revenue retained over a given period.

Net retention rate measures the overall growth of the installed base; it captures both the negative impact of cancelled customers and contractions, but also the positive impact of price increases, upsells and cross-sells. Gross retention rate eliminates the impact of price increases, upsells and cross-sells.

2. Customer Retention (CRC) and Expansion (CEC) Costs

Customer acquisition costs (CAC) metrics are widely used across the SaaS industry. CRC and CEC are less prevalent but gaining attention to guide post-sale investments.

While gross and net retention rates are quickly becoming table stakes, companies rarely measure their investments in each of these growth levers. CRC and CEC (and their respective ratios) provide a way to explicitly plan, allocate investments and measure efficiency across retention and expansion efforts.

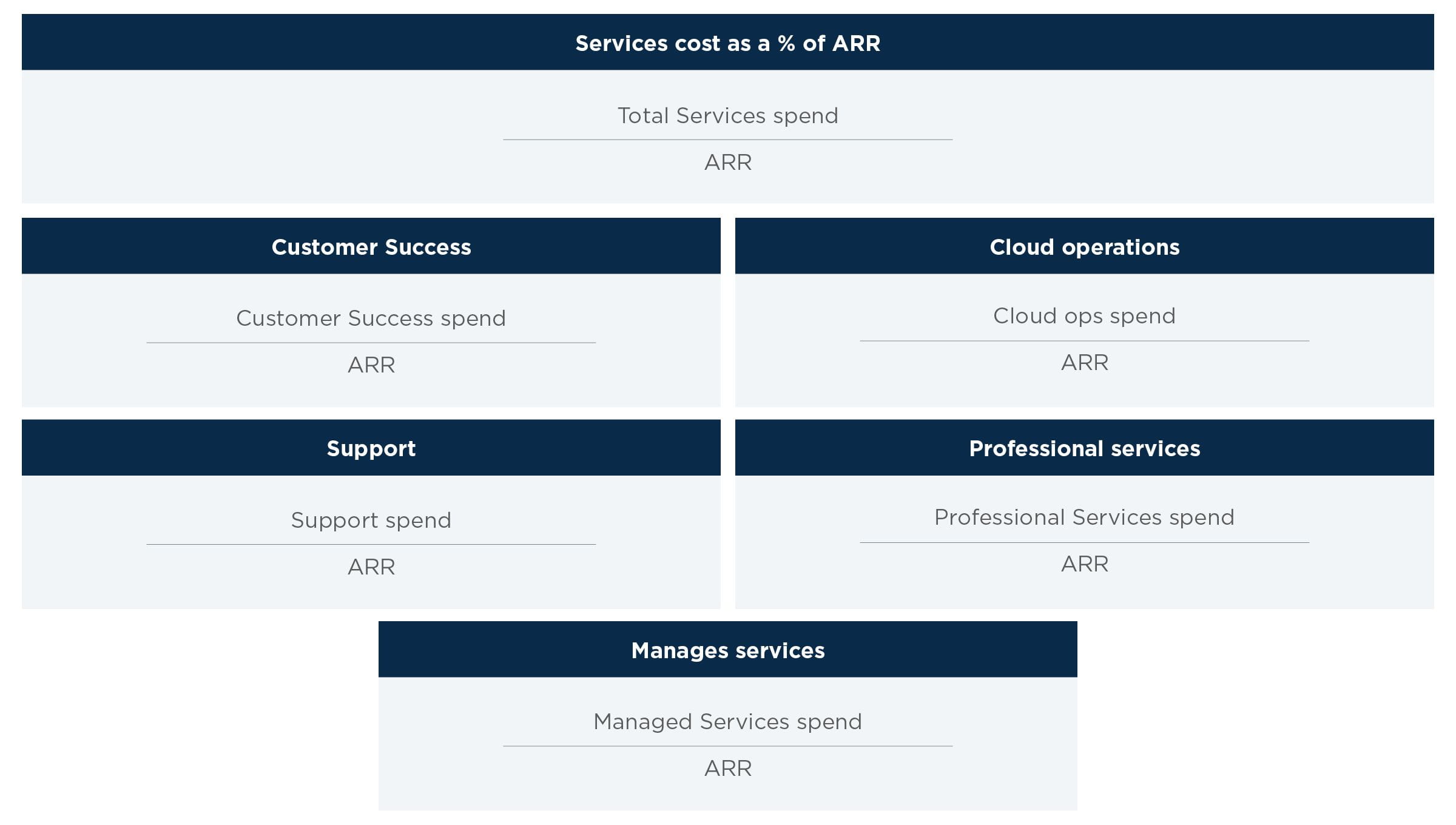

3. Service Cost as a Percentage of ARR (by function)

The ultimate goal in a subscription business is to drive ARR. Sales, Marketing, Product Development and Service functions should all be driving towards this singular goal. So why would you budget your Services functions any other way? We’re increasingly seeing companies shift away from traditional functional P&Ls and embrace service costs as a percentage of ARR to frame their overall Services budget. If you want a bigger budget, help drive more ARR.